I woke this morning thinking about what I was panicking about. My credit card bill has gotten a bit out of control and I have no idea how to pay it off. I know, you're thinking "A financial planner who doesn't know how to pay off credit card debt? I don't know if that sounds legit." The thing is, it's not that I don't know how to pay it off, it's that I haven't bothered to yet do the research for how I'm going to do this. So I've ignored it for a few months hoping the money would materialize to pay it off so I could just give it all one lump sum and it all be gone. I'm particularly bad at dealing with credit card balances unless they're planned purchases. For instance, I put my monthly payment for my car warranty on my credit card, so I know at the end of the month I have to pay off that amount at minimum. However, a few extra purchases have snuck onto that card (like over zealous Christmas presents) and I haven't dealt with them. To top it off, this credit card has tricky interest rules so some purchases get charged interest and some don't. For full disclosure, this is a Discover card I've had since I was 18 and I have yet to read through all those damn rules. Ick.

As I was avoiding mud puddles and huffing my way up a way-too-steep-hill this morning on my run, I realized what I needed was a cash flow statement.

Clients of mine who are small business owners and freelancers have heard me preach about cash flow statements and I am surprised by myself that I haven't maintained the one I started last May. I guess the expression "Do as I say, not as I do" really applies here.

So I realized that instead of doing mine and feeling a huge sense of relief, I would walk you all through how to construct a cash flow statement so you could avoid your own mini panics and instead understand not just where your money is going, but when it's going.

Another disclaimer, this format is borrowed heavily from my friend Mari Geasair. She's a coach and helped me with the initial steps of Artistic Financial Planning and is amazing with marketing. Check out more about her business here.

First, open your favorite spreadsheet processor, like Excel.

Next, list across the top the starting dates of the next few weeks. My planner happens to run Monday-Sunday so that's how I view my weeks. It should look like this:

Next, list your income sources along the side and insert when you're expecting income from those sources. Your first income source should be "cash on hand" or basically how much you currently have in your bank account, subtracting any pending transactions that haven't cleared quite yet. Add all those up in a total on the bottom.

Next come your expenses. List all those as they're expected to pay out. Some of your expenses will be estimates based on the past month. Others can be exact and take into account things like when you're going to be hosting a dinner party in your grocery budget or when your mom is coming to town and she loves to keep her guest room at 80*, thus causing your electricity bill to go up.

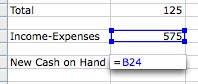

Then you'll subtract your Income from your Expenses by subtracting your Income from your Expenses. And if you don't know how to do this in Excel, you will be saved momentarily by my amazing offer.

The difference is your New Cash on Hand. You'll make a line of this across the bottom and make the cash on hand line for your next week equal this number from the week before. Like so:

Finally, drag these formulas across the Cash on Hand, Totals, Income-Expenses, and New Cash on Hand rows so you can apply them to all the columns. Now you have a comprehensive look at where and when your money is going.

Now if all of that seems lovely, but you just are not interested in setting up the spreadsheet. You're in luck! I've saved it into my Dropbox here and you can open it and use it at your leisure. It has the same values you see here, so add and delete as you deem necessary. And please let me know how it goes!

No comments:

Post a Comment